Navigating the Delaware & Sussex County Improvement Tax: What You Need to Know

(Caveat: This blog provides Turnstone Custom Homes' understanding of the relevant State and County "Improvement Tax" Code sections and Sussex County's current practices as of May 2025. Always consult with an attorney to evaluate your specific exposure to this tax.)

If you have recently purchased real property in Sussex County, Delaware, and are planning to build a new home or undertake a significant renovation, you might encounter a tax that often surprises new landowners: the “Improvement Tax”.

While commonly referred to as the Improvement Tax, this levy is actually an extension of the Realty Transfer Tax (RTT), which is typically assessed when you buy or sell real property. The Improvement Tax kicks in when you sign a contract for construction on land, or renovation to buildings, that you've owned for less than a year.

Why Does This Tax Exist? Closing a Perceived Loophole

The Improvement Tax was initially established to address a perceived loophole in the RTT system. The logic was that someone buying a vacant lot and quickly building a new home (or performing a major overhaul) shouldn't pay less transfer tax than someone who purchases a completed home.

Before the Improvement Tax was enacted, developers could reduce their exposure to transfer tax (and the buyer’s exposure) by selling a lot to a buyer and subsequently entering into a separate construction contract. The substance of the transaction is very similar to the sale of a finished home but with a lower tax burden for the developer and the buyer. The goal of the Improvement Tax was to eliminate that loophole.

However, there is one key difference: When purchasing a completed home, the RTT is typically split between the buyer and seller. In contrast, a buyer undertaking new construction on their recently acquired lot or home bears the entire burden of the Improvement Tax.

How the Improvement Tax Works in Sussex County

While the framework for the transfer tax originates at the State level, Sussex County plays a crucial role in its implementation when it comes to improvements made within one year of the initial purchase of the property. The trigger for assessing the Improvement Tax is usually the submission of a "document" to the County.

Sussex County defines a "document" to include a contract for home construction or major renovation. The County becomes aware of these contracts when a builder or homeowner applies for a building permit. The bottom line is this: in Sussex County, you generally cannot obtain a building permit (or a Certificate of Occupancy) until the Improvement Tax has been paid.

Notably, the Sussex County share of the Improvement Tax does not apply when the property is located in a municipality.

Understanding the Tax Rate

The Improvement Tax involves both State and County components:

The State of Delaware assesses a tax of 2% on the amount of the construction contract, after deducting a $10,000 exclusion.

Sussex County also assesses a tax of 1.5% on the total construction contract amount. Importantly, you'll need to pay the County portion and show proof that the State portion has been paid before the County will issue your building permit.

Therefore, the combined effective tax rate is slightly less than 3.5% of your total construction cost, and this entire amount is the responsibility of the homeowner.

How the Improvement Tax Applies to Renovations

The rules also cover significant renovations on recently purchased property.

State Code: Defines a taxable renovation as one where the cost of the renovation contract (signed within one year of property purchase) exceeds 50% of the value of the property transferred.

County Code: Contains similar language but refers to 50% of the value of the land transferred.

Important Note: The County Code's reference to "the value of the land transferred" is potentially a drafting error. We believe the correct interpretation should align with the State Code (50% of the value of the entire property) and we confirmed that interpretation with Sussex County in 2025. If this provision applies to your situation, it's especially critical to consult with your attorney for clarification.

Recertifying Construction Costs

Be aware that the actual costs of your construction project may be reviewed when you apply for your Certificate of Occupancy. If there's a difference between your initial construction contract amount and the final cost of the project, you may be responsible for paying additional tax on the increased amount. This recertification is accomplished by filing a second Delaware Form RTT-BPA. On Page 2, Line 3(d) you can deduct the RTT previously paid “on the same construction”. You SHOULD NOT deduct the RTT you paid on the initial purchase of the property on Line 3(d).

Strategies for Potentially Avoiding the Tax

The most straightforward way to avoid the Improvement Tax is to wait until one year has passed since you purchased the property before signing a construction contract and applying for permits.

However, this strategy comes with its own set of risks:

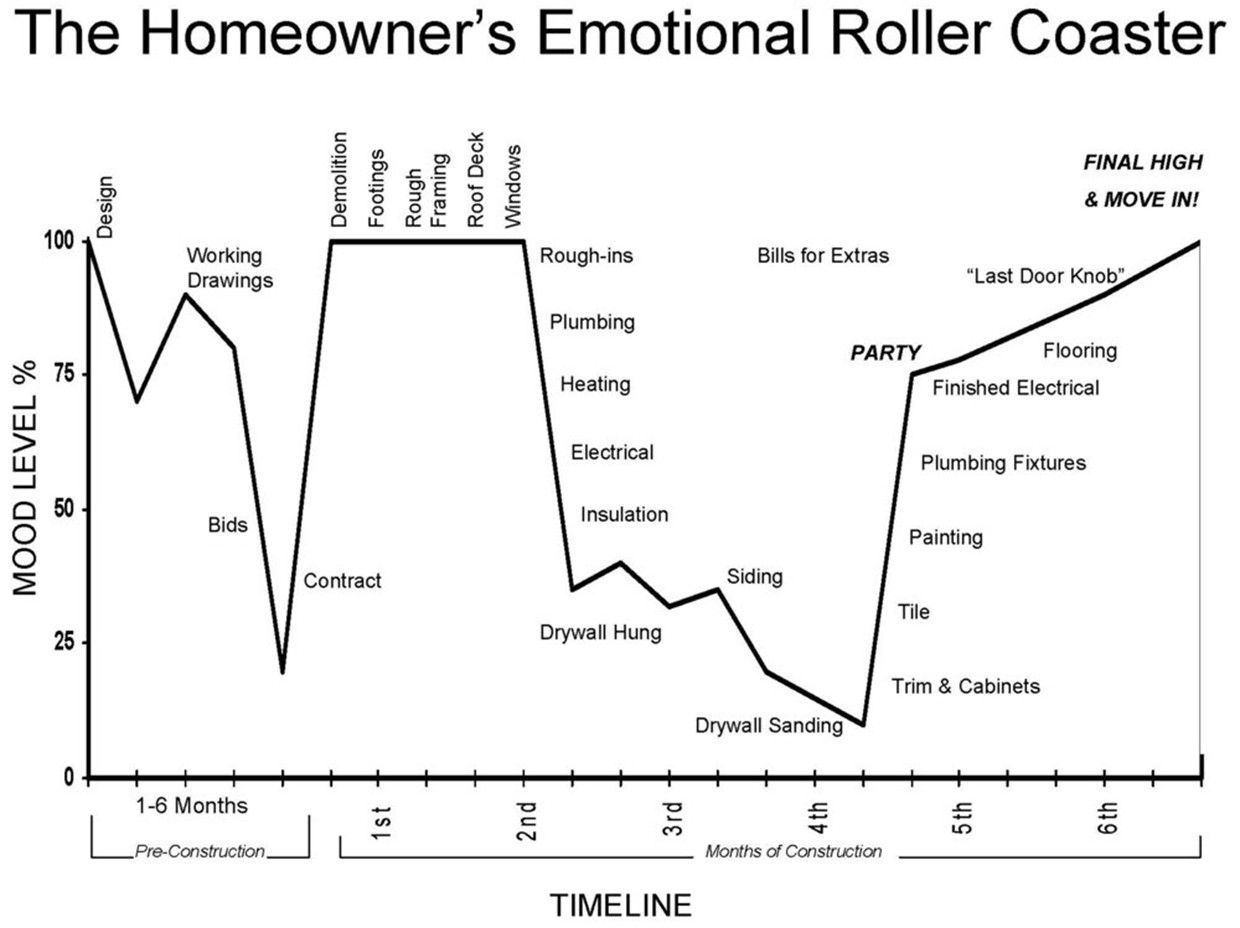

Increased Construction Costs: The price of building materials and labor can fluctuate significantly over a year. Waiting could lead to higher overall construction costs, potentially wiping out any savings from avoiding the tax. Builders typically cannot guarantee their bids for extended periods due to the volatility of commodity prices.

Lost Usage or Rental Income: Especially relevant in the resort market, delaying construction could mean missing an entire summer season of potential personal enjoyment or valuable rental income. In some cases, proceeding with construction immediately and renting out the property for a few summer weeks will generate enough revenue to offset the cost of the Improvement Tax.

Lower Capital Gains Tax Basis: If you choose to pay the Improvement Tax and get started right away, the tax paid will increase your tax basis in the property and may reduce any eventual capital gains tax you will owe on the resale of the improved property.

How Turnstone Can Help

At Turnstone Custom Homes, we understand the complexities of the Improvement Tax. One of the first questions we ask new prospects is, "How long have you owned your property?" If you've owned it for less than a year, we will proactively discuss your options, explain the implications of the Improvement Tax, and help you make an informed decision about the timing of your building permit application.

Don't let the Improvement Tax catch you off guard. Contact Turnstone Custom Homes today to discuss your building plans and ensure a smooth and informed construction process.

____________________________________________________________________________________

Relevant Sussex County Code Sections as of 3/31/2025

Note – the reader of this blog post is responsible for determining if the Code(s) copied below have since been amended.

Documents; issuance of building permits and certificates of occupancy; building.[103-18 (I)(1) Added 12-2-2008 by Ord. No. 2007]

Notwithstanding the foregoing provisions of this section, there shall be included in the definition of "document" for the purposes of this article any contract or other agreement or undertaking for the construction of all or a part of a building, all or a portion of which contract, agreement or undertaking (or any amendment to the foregoing) is entered into, where labor or materials are supplied, either prior to the date of the transfer of the land on which the building is to be constructed or within one year from the date of the transfer of the land to the grantee.(2)

The County shall not issue a building permit for any such building unless and until the person or persons (including corporations, other associations or entities) requesting such permit shall demonstrate in whatever form may be specified and required by the County Director of Finance, including at the Director's discretion, a form of affidavit certifying that:

No transfer as described in this section has occurred within the preceding year; or

No portion of the contract for construction for which the permit is being requested was entered into and no materials or labor with respect to the building have been provided within one year of the date on which the land was transferred; or

The required amount of the County realty transfer tax on the document, as defined in this article, has been paid.

[103-18 (I)(4) Added 12-2-2008 by Ord. No. 2007]

A building" for the purposes of this article shall mean any structure having a roof supported by columns or walls which structure is intended for supporting or sheltering any use or occupancy and shall not include any alteration of or addition to any existing building where the cost of said alteration or addition is less than 50% of the value of the land transferred.

Relevant State of Delaware Code Sections as of 3/31/2025

Delaware Code Title 30

CHAPTER 54. REALTY TRANSFER TAX

Subchapter I. Realty Transfer Tax

(9)a. Notwithstanding paragraph (1) of this section, there shall be included in the definition of “document” for purposes of this chapter any contract or other agreement or undertaking for the construction of all or a part of any building, except for 1 or more buildings of which 85% or more of the total square footage was constructed for the purpose of manufacturing, as defined in § 2701 of this title, all or a portion of which contract, agreement, or undertaking (or any amendment to the foregoing) is entered into, or labor or materials are supplied, either prior to the date of the transfer of the land on which the building is to be constructed or within 1 year from the date of the transfer to the grantee.

b. No jurisdiction in this State shall issue a building permit for any such building unless and until the person or persons (including corporations or other associations) requesting such permit shall demonstrate in whatever form may be specified by the Director of Revenue, including at the Director's discretion, a form of affidavit, that:

1. No transfer as described in this section has occurred within the preceding year;

2. No portion of the contract for construction for which the permit is being requested was entered into and no materials or labor with respect to the building have been provided within 1 year of the date on which the property was transferred; or

3. There has been paid a realty transfer tax on the document as defined in this paragraph.

b. A jurisdiction in this State may not issue a building permit for a building unless the person or persons (including corporations or other associations) requesting the permit demonstrates in whatever form may be specified by the Director of Revenue, including at the Director’s discretion, a form of affidavit, that 1 of the following applies:

1. A transfer as described in this section has not occurred within the preceding year.

2. A portion of the contract for construction for which the permit is being requested was not entered into, and materials or labor with respect to the building have not been provided, within 1 year of the date on which the property was transferred.

3. There has been paid a realty transfer tax on the document, as defined in this paragraph (9)b.3.

4. The grantee of the property, or an entity that is part of an enterprise with common ownership or common direction and control with the grantee of the property, is or will be licensed as a manufacturer under Chapter 27 of this title.

c. In addition, no jurisdiction in this State shall issue a certificate of occupancy relative to any building on which a tax is provided by this subsection unless and until the owner recertifies the actual cost of the building and pays any additional tax due as a result of such recertification.

d. A “building” for purposes of this paragraph (9)d. shall mean any structure having a roof supported by columns or walls which structure is intended for supporting or sheltering any use or occupancy but shall not include any alteration of or addition to an existing building where the cost of said alteration or addition is less than 50% of the value of the property transferred.

e. A “transfer” for purposes of this paragraph (9)e. shall include any transfer made by a “document” as described in this section, other than this paragraph (9)e., and shall not include any transaction excluded from the definition of “document” under the provisions of paragraphs (1)a.-u. of this section.